Most term policies are designed to run longer than their level term period but at a higher price that increases every year after the level premium period ends.

What happens at the end of a 20 year term life insurance policy.

Permanent life as the name suggests lasts your whole life.

Term life insurance expires at the end of the chosen term length but is renewable through age 95 in most cases.

Unless you have a return of premium insurance policy do not get your money back at the end of a term life insurance policy.

Or your health might make buying a new affordable term life policy difficult if not impossible.

Rather than buying a new term life policy for five or more years you could opt for annual renewable term life insurance where you decide each year whether to continue coverage.

We bought a 20 year term life insurance policy when my husband was 59 years old and paid a handsome premium of 3595 all these years.

What to do when your term life insurance policy expires.

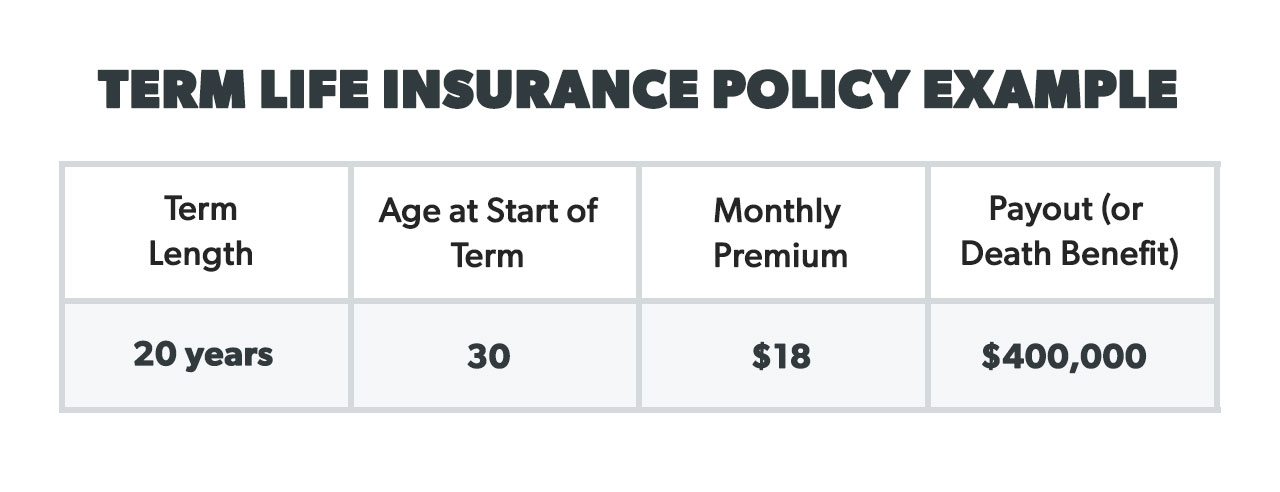

In most cases 20 year level term life insurance is the average premium for the first 20 years of coverage.

It s one of the simplest forms of life insurance on the market.

You might not be able to renew your term life policy either.

Converting your policy to a permanent policy at the end of the term most term life insurance policies come with a built in rider called a term conversion rider which gives you the ability to convert your term policy to a permanent policy when the term expires.

You pay the premiums and in exchange your beneficiary could receive your insurance coverage if you died.

The rates are typically so expensive many people can t afford them.

Most term policies typically turn into an annually renewable term art policy which basically means your life insurance rates at the end of your term will increase significantly.

He will soon be 79 and the policy will terminate.

So if you selected a 20 year term life policy the policy expires 20 years after it went into force.

If you outlive your policy your beneficiaries won t receive a death benefit and you won t receive any money in return unless you have a return of premium policy.

So with this question a 20 year term life policy would most likely be a flat level premium for 20 years then an increasing premium there after if the insured wants to continue the policy.

From the 21st year and above it reverts to an annual renewable policy art.

If you outlive your term life insurance policy you can choose to renew it or convert it to whole life.

We only got a bill every year and did not know that our agent passed away a few years after we bought the policy.

Term life offers protection for a limited amount of time such as 10 20 or 30 years for cheaper premiums than permanent.